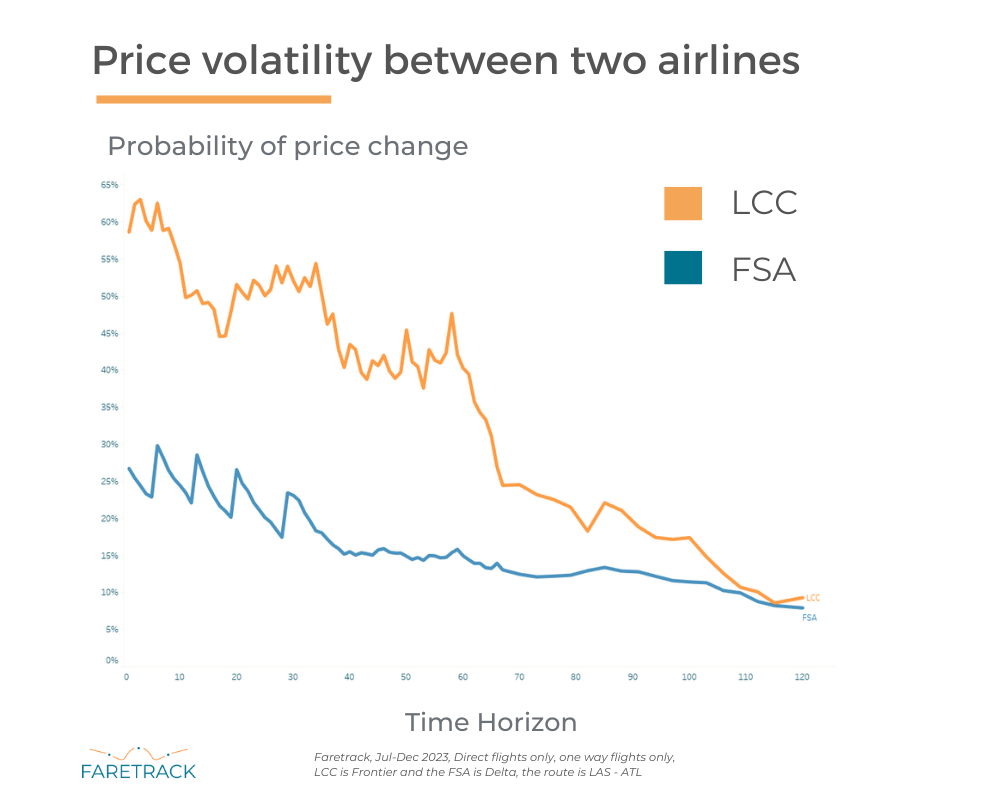

Using FareTrack’s pricing behavioral analysis solution Optimize, we recently decided to take a look at two pricing approaches for a Low Cost Carrier (LCC) and a full service airline, to understand pricing dynamics and volatility, and crucially the impact this has on competitor fare extraction schedules. For the comparison, we used a popular route Las Vegas to Atlanta and took a look at pricing volatility over 180 days out from departure.

Unsurprisingly, this analysis has unveiled a stark contrast in the pricing philosophies adopted by these two players.

The LCC, known for its budget-friendly approach, embraces a dynamic and open pricing strategy. In contrast, the FSA adheres to a more traditional, rules-based approach. This rules-based method entails fixed pricing linked to booking classes. As certain classes of seats are filled up and new ones open, price adjustments follow suit. The foundation of this strategy rests upon fare rules stipulating closure timings for booking classes 7, 14, and 21 days before departure.

The disparity between the two strategies doesn’t end there. LCCs typically adopt a simplified fare structure, featuring fewer booking classes. This simplicity not only streamlines the booking process for customers but also allows the airline to be more responsive to real-time demand for specific flights. Furthermore, as LCCs core customers are more cost-conscious, LCCs closely monitor their competitors and adjust their prices in real time to stay competitive in the market. This agility sets them apart from FSAs, which are often bound by more rigid pricing structures.

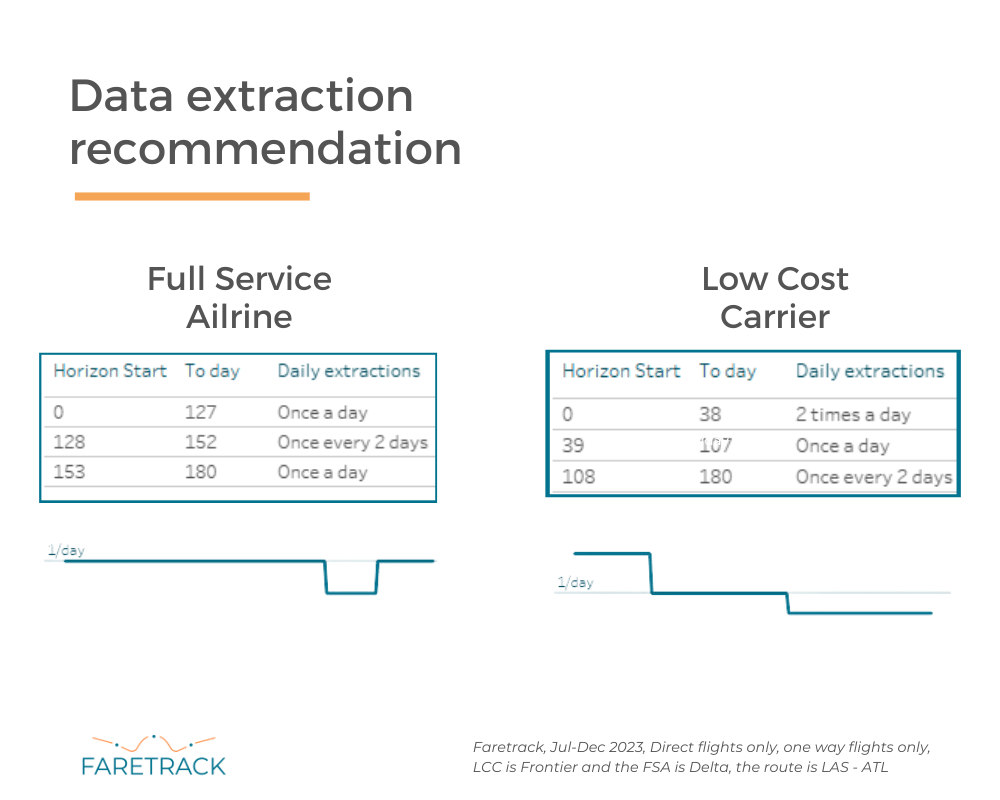

One of the key insights that emerged from our investigation is the probability based optimal schedule for extracting competitor pricing data. For FSAs, a relatively stable pricing pattern is discernible from day 0 to 127 and from day 153 to 180. This steadiness suggests that a data collection frequency of once a day is sufficient during these periods. However, in the window between days 128 and 152, where pricing changes are infrequent, an every-other-day schedule for data extraction would be more cost-effective whilst not losing meaningful insights in exchange.

Conversely, the LCC showcases a much more volatile pricing dance. It’s during the period from day 153 to 180 that a recommended daily data extraction schedule is deemed most prudent, extending back to the 128–152-day range. Yet, it is the initial 38 days that stand out as the most tumultuous phase, characterized by substantial price fluctuations. To capture these dynamic shifts effectively, a twice-daily data extraction schedule is recommended.

For airlines striving to decipher the intricate pricing behaviors of their competitors and aiming to establish probability based data extraction strategies, FareTrack Optimize is an essential ally. This innovative tool opens doors to insights that were once hidden, offering a unique vantage point into the revenue management strategies of competing airlines, all based on behavioral fare movement probabilities.

Experience the power of FareTrack Optimize for yourself. Unearth previously undiscovered data insights, fine-tune your pricing strategies, and soar ahead of the competition. Sign up for a free trial here Optimize

Ready to soar to new heights? Unlock the potential of FareTrack Optimize now at sandbox.faretrack.ai/optimize.