The changing world of airline pricing and revenue management is presenting new data challenges to operators. Relying on traditional data sources could mean you are missing out on critical data to inform better decision-making.

The highest selling statistics book in the second half of the 20th century was a book called ‘How To Lie with Statistics’ by Darrel Huff. One of the stories within the book was from World War II. In it, the Statistical Research Group of Columbia University had been tasked with analyzing damage patterns on fighter aircraft that had returned from combat missions. The brief from military command was to identify the areas that showed the most damage, assuming that those were the most vulnerable parts of the plane and should therefore be reinforced. One of the statisticians, Abraham Wald, realized that the damage patterns on the returned planes only showed where a plane could be hit and still survive. What he could not see were the areas that were hit in an area that resulted in the destruction of the plane. His conclusion was that the areas with no damage on the returned planes were the places where planes that were hit didn’t survive to return. Therefore, those undamaged areas were the ones that needed to be reinforced.

As a data analysis problem this is called ‘Survivorship Bias’, that is focusing on and acting on only the data you see. Wald’s work on this problem became the foundation of the discipline of Operations Research, the application of analysis to improve decision-making.

How this is relevant to Airline Revenue Management and Distribution

Traditionally, airlines distributed fares and rules through the Airline Tariff Publishing Company (ATPCo) to Global Distribution Services (GDS). This process was rigid and universally followed. As a result, gathering intelligence on competitive fares was based exclusively on data from those GDS.

However, with the advent of New Distribution Capability (NDC) airlines can now bypass the GDS channel and distribute directly to airfare sellers. In 2019, NDC adoption was estimated at 21% of fares, with 55% of airlines having an NDC program in place (Skift, 2020).

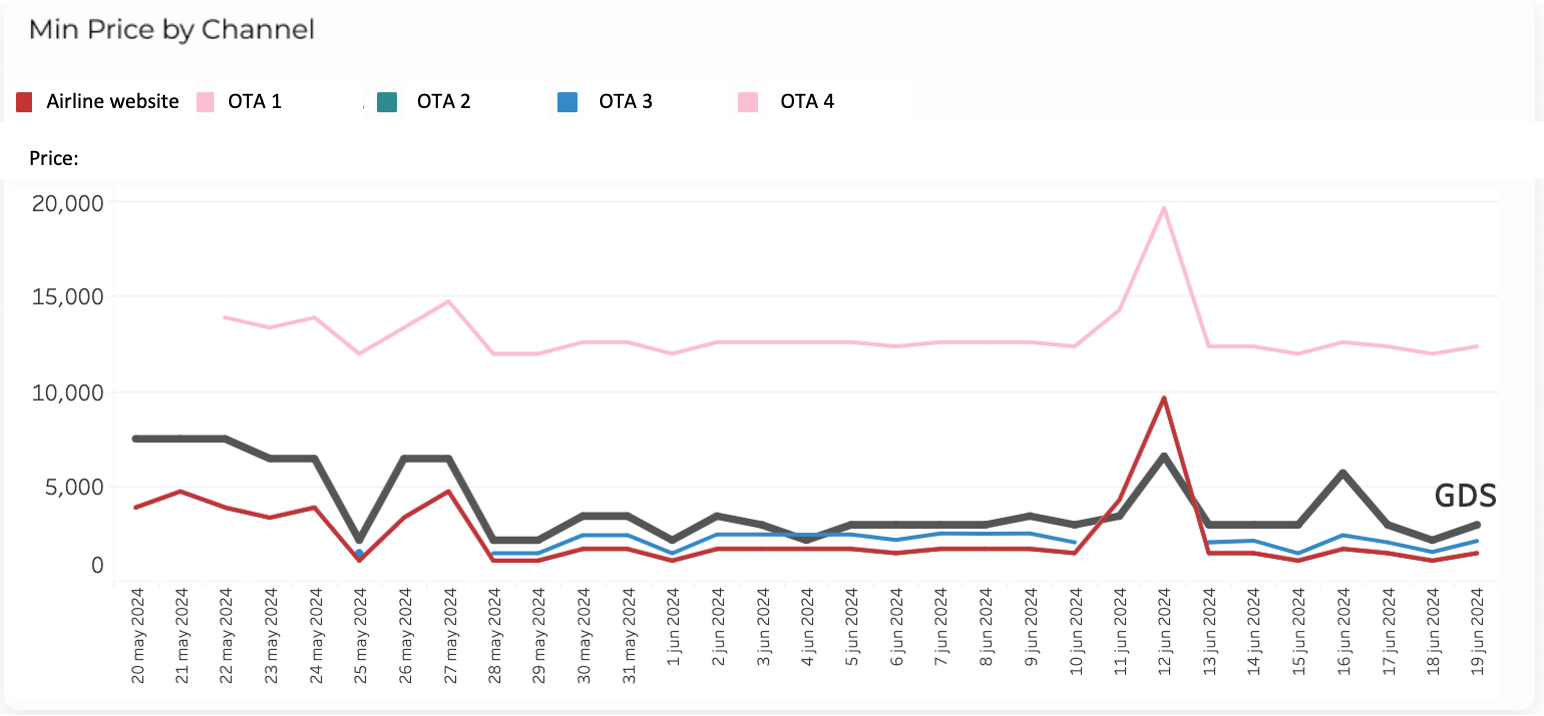

The impact on the process of gathering competitive intelligence is significant. Airlines that use GDS data as the foundation of their competitive intelligence are now falling victim to survivorship bias. As demonstrated in the graph below (from FareTrack), GDS fare data only tells some of the story:

Online channels are where the most competitive content resides.

So, just as the military in WWII wanted to focus on only visible data, airlines focusing on GDS data are neglecting potential critical vulnerabilities in their pricing strategy.

The lesson is that airlines must deploy tools that enable broad vision across multiple channels and they must analyze, gather and use data from those channels. This requires a re-think in how to approach competitive fare monitoring to avoid survivorship bias – something that could be costing an airline millions of dollars per year.